After submitting a 1099-S filing, you may need to make corrections. These corrections can easily be done within InfoTrack.

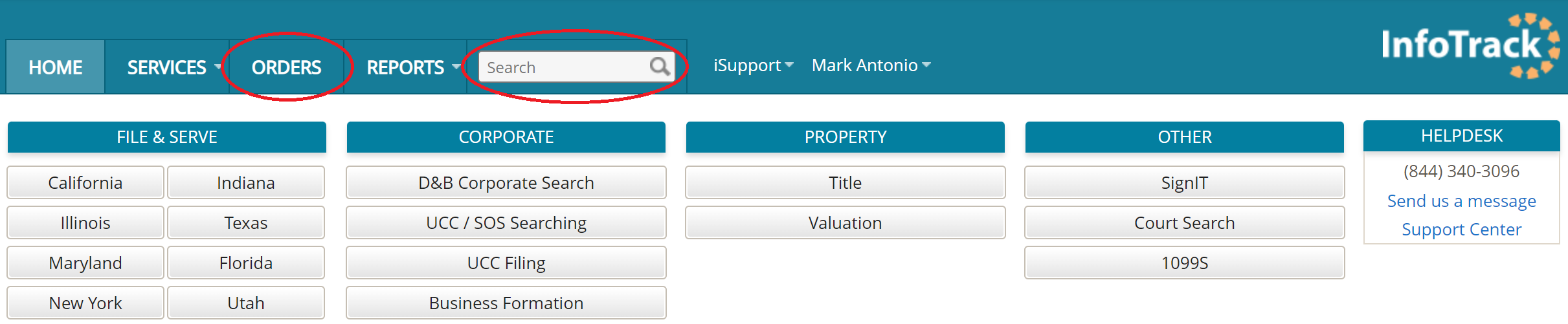

Step one: From the InfoTrack dashboard, navigate to "Orders" or use the "Search" toolbar to find the order you wish to correct.

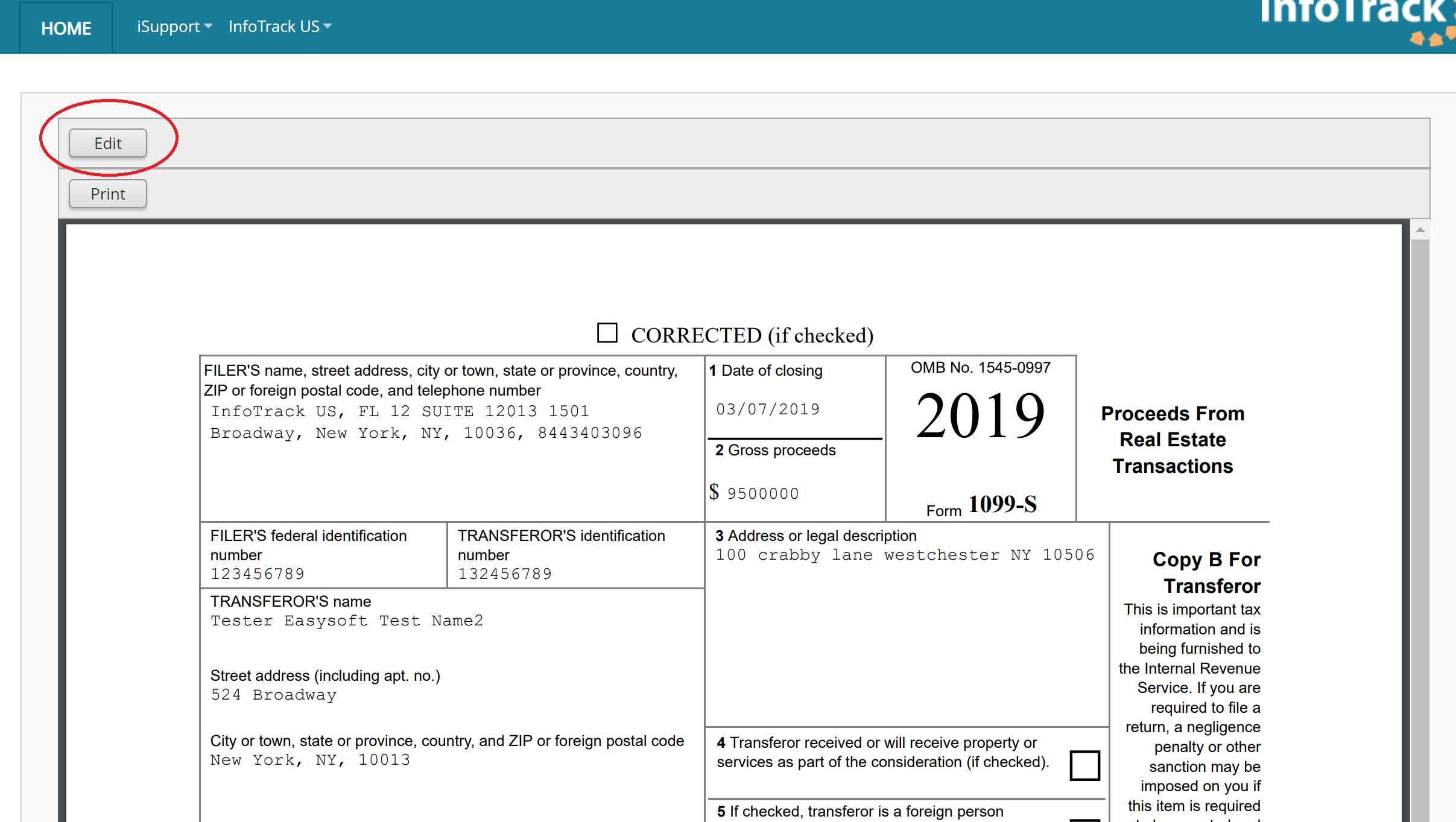

Step two: Click on your order to preview it, select Edit and make the necessary changes to the transaction and seller's information.

Step three: When you have finished editing the form, click Submit.

Note: Edits can be made throughout the tax year, up until InfoTrack's cut-off (last working day of January). On the last working day of February, you will have one final opportunity to make corrections through InfoTrack at no extra cost. It is the responsibility of the filer to send a copy of the corrected filing to the seller. All changes for previous tax years will come with a charge of $80-$85 for each filing that needs to be corrected.