Corrections can be made to 1099-S filings from within Easysoft CDF and HUD throughout the year up until the tax year deadline.

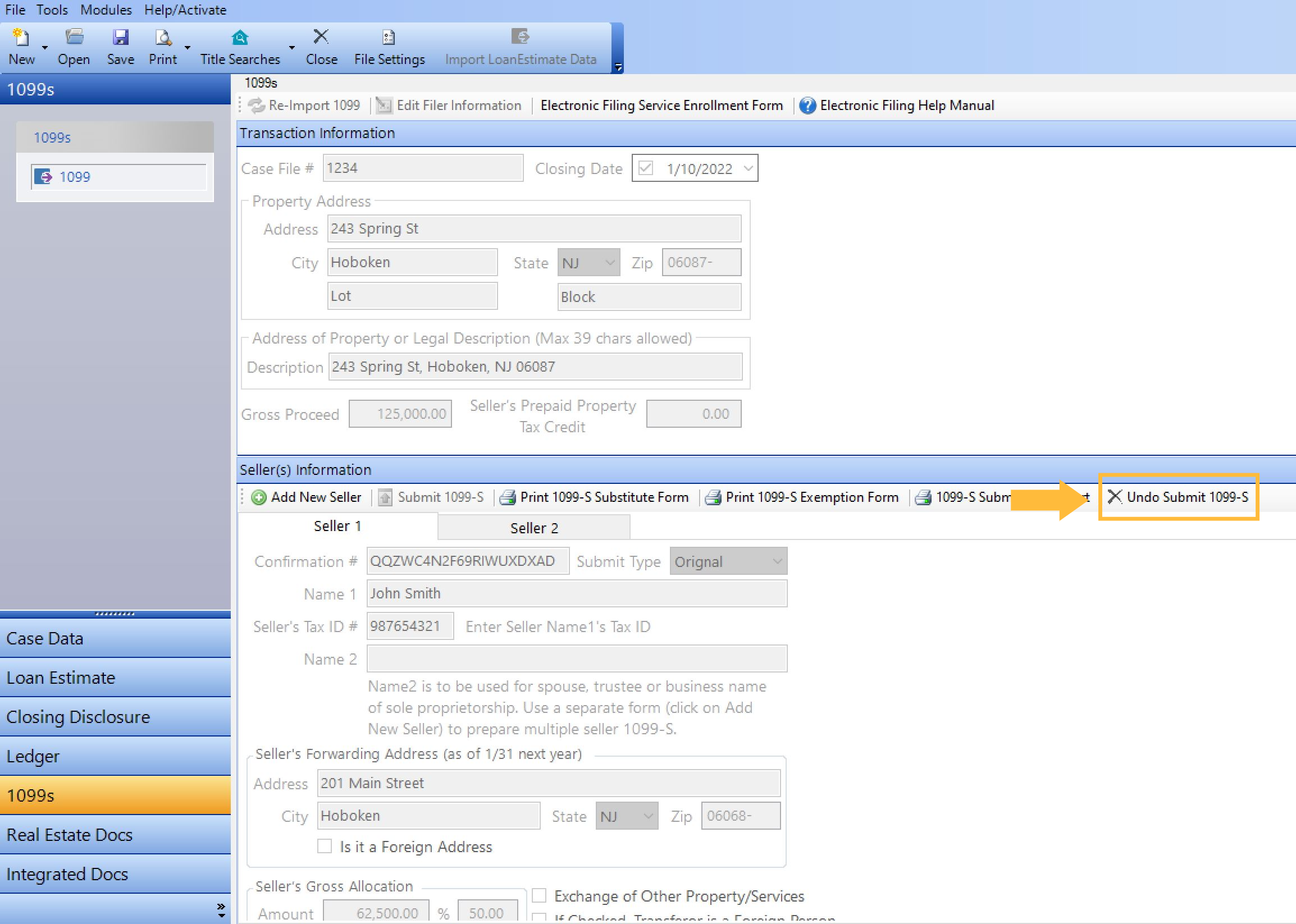

To make a correction to a 1099-S filing within Easysoft CDF or HUD, start by opening the case in Easysoft that you filed the 1099-S from. Navigate to the 1099-S tab where you will notice the page is grayed out indicating that the form has been filed. Under Seller(s) Information click on Undo Submit 1099-S.

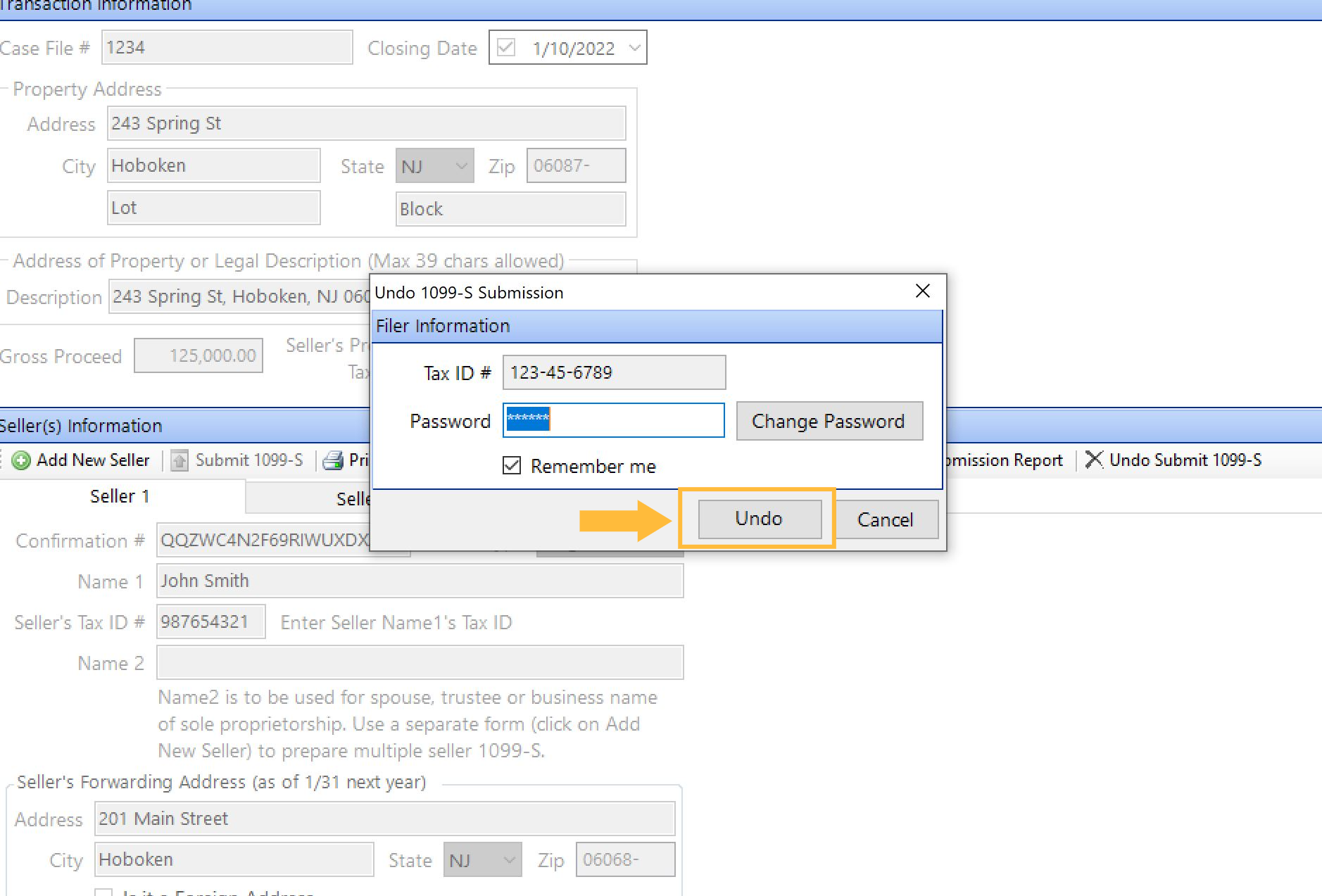

You will be presented with a prompt reminding you that you will need to re-submit after making your corrections and then you will need to enter your InfoTrack password and select Undo.

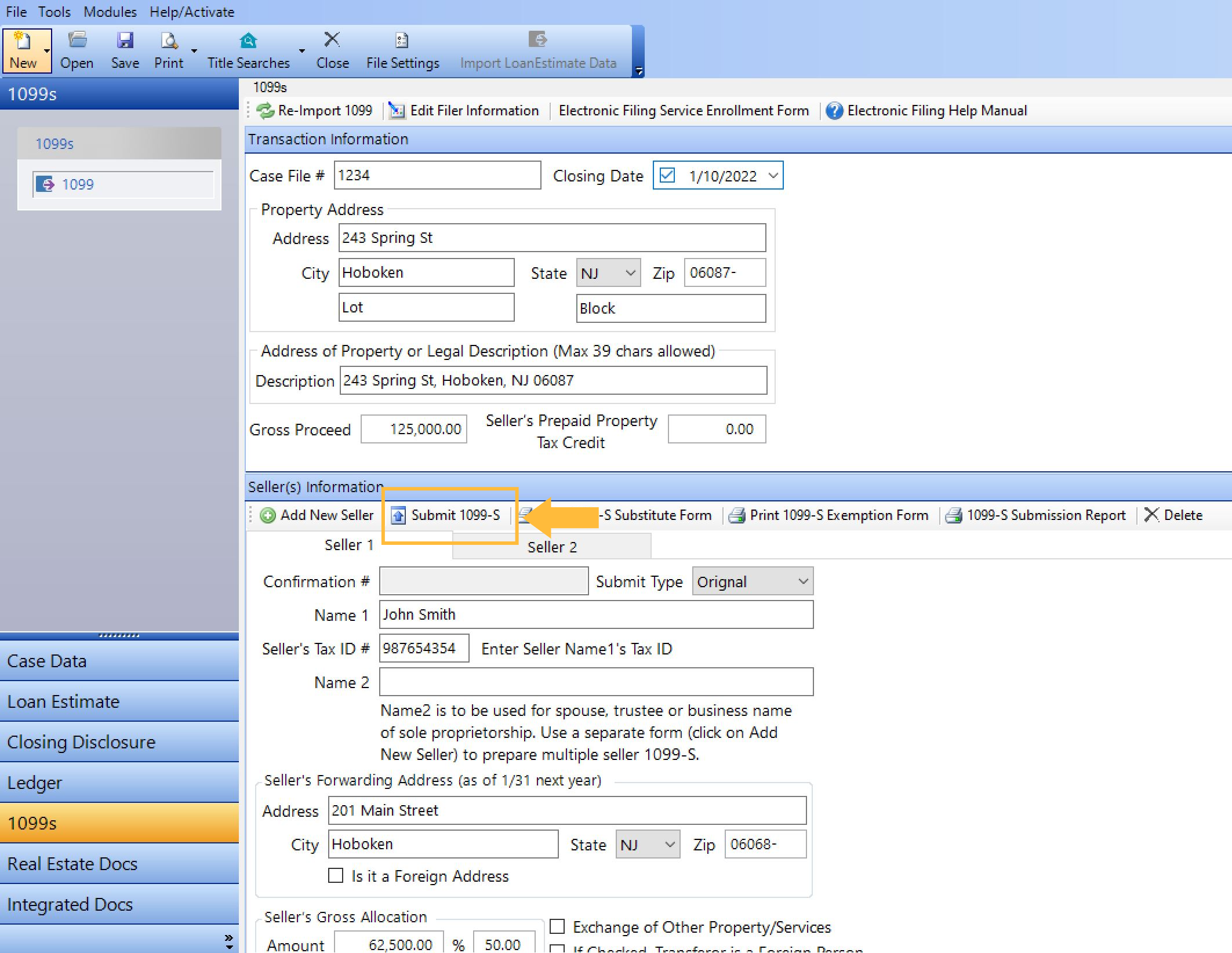

This will re-open the 1099-S allowing you to make any required corrections. Once you have finished correcting the information on the 1099-S select Submit 1099-S to resubmit the form.

Note, if there is more than one seller and you need to make corrections to each seller's 1099-S you will need to do so one at a time. After making corrections to Seller 1's 1099-S, navigate to Seller 2's tab and follow the above steps and so on for each seller.