As part of InfoTrack's 1099-S service we provide the option to download and print an exemption form when requested.

What is a 1099-S exemption form?

The information entered on the exemption form determines whether the proceeds from a Real Estate sale or exchange should be reported to the Internal Revenue Service (IRS) on Form 1099-S.

When filling out the exemption form if you check all 6 boxes on the form, then the 1099-S is not required to be submitted to the IRS. You can print the 1099-S exemption form, have it signed by the seller and keep it on file. Only at the request of a seller should the 1099-S exemption (exclusion) form be used.

How to prepare the 1099-S exemption form

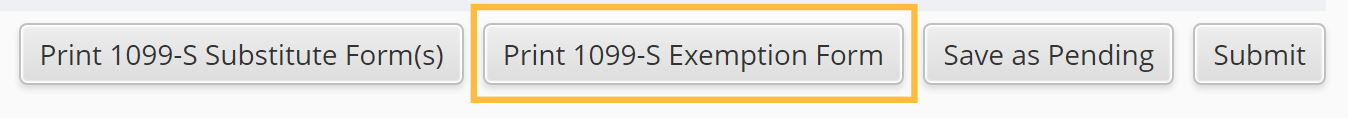

To prepare and print the exemption form from your InfoTrack account, navigate to 1099-S and click on Print 1099-S Exemption Form(s) at the bottom of the 1099-S filing page.

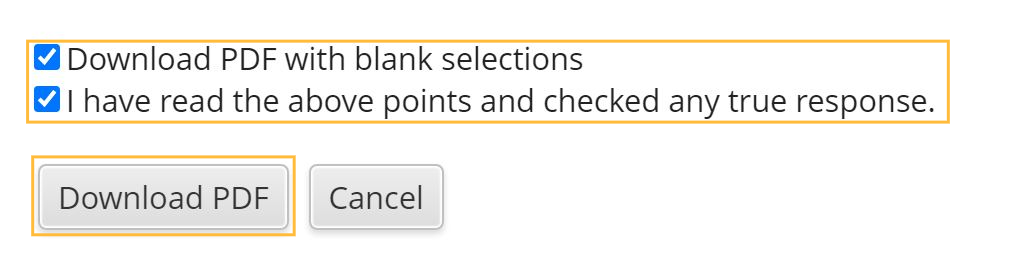

Select the required assurances or if you want the seller to select the required assurances themselves, select Download PDF with blank selections.

Click on Download PDF.

Signed exemption forms are for your records only. InfoTrack does not require a copy of the exemption form to be uploaded once complete.